Discovering Zero Debt High Growth Stocks 💡

Do you love high-growth companies that are lean, efficient, and built for success? Imagine a company not just growing rapidly but also carrying zero financial deadweight. Intrigued? So were we!

Selection Criteria For Zero Debt High Growth Stocks

– Return on equity ( ROE ) > 15%

– Sales Growth 5Years > 20%

– Profit Growth 5Years > 20%

– Debt to Equity = 0

– Market Capitalization > 5000 Crores

We applied some smart filters—zero debt, a market cap of at least ₹5000 crore—and identified three exceptional companies with the highest ROE (Return on Capital Employed) and growth rate. Here’s the countdown:

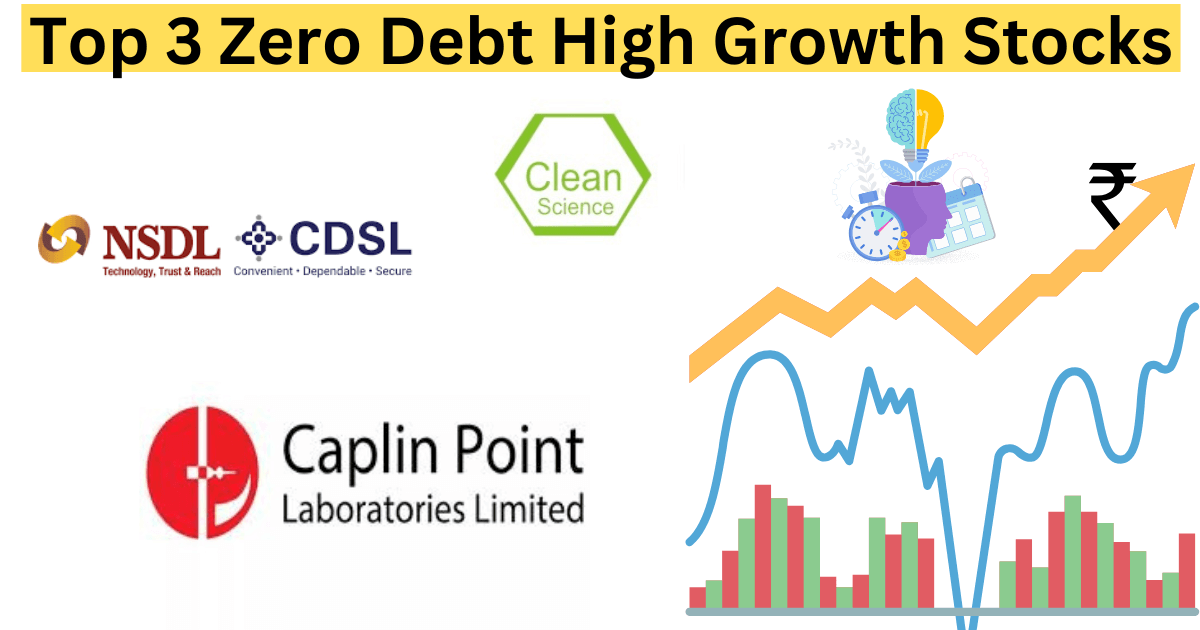

Top 3 Zero Debt High Growth Stocks

3️⃣ Caplin Point Laboratories Ltd (Pharma)

With an ROE of 22.4%, this pharmaceutical company Caplin Point Laboratories Ltd is paving the way in its sector, delivering robust returns and sustainable growth.

2️⃣ Central Depository Services Limited (CDSL)

India’s largest security depository firm boasts an impressive ROE of 31.57%. A clear leader in its niche, CDSL is empowering the Indian financial ecosystem with its innovative services.

1️⃣ Clean Science and Technology Limited

And the top spot goes to Clean Science, a leading specialty chemical manufacturer, with a staggering ROE of 34.93%! Known for its green technology and sustainable practices, Clean Science is not just growing—it’s revolutionizing the industry.

These companies exemplify the power of efficient capital utilization combined with zero debt. While these metrics are exciting, always remember to conduct your own due diligence before investing. 📊💰

If you found this interesting, don’t forget to like, share, and spread the word! 🗣️

ALSO READ

Liked our article ? Subscribe to get weekly updates