Investing is a great way to grow your wealth over time. However, it can be difficult to estimate the returns on your investments. This is where the Rule of 72 comes in handy. In this blog post, we will explore what the Rule of 72 is and how it can help you estimate investment returns.

What is the Rule of 72?

The Rule of 72 is a simple mathematical formula that can help you estimate the number of years it will take for your investment to double based on a given rate of return. The formula is as follows:

Number of years to double = 72 ÷ Annual rate of return

For example, if you invest in a mutual fund that has an annual rate of return of 8%, the Rule of 72 can be used to estimate that it will take approximately 9 years for your investment to double (72 ÷ 8 = 9).

How to use the Rule of 72

Using the Rule of 72 is simple. All you need to do is follow these three steps:

Step 1: Determine your annual rate of return

The first step is to determine the annual rate of return on your investment. This can be done by looking at historical returns of the investment or by consulting with a financial advisor.

Step 2: Divide 72 by the annual rate of return

Once you have determined the annual rate of return, divide 72 by the rate of return. This will give you an estimate of the number of years it will take for your investment to double.

Step 3: Estimate your investment returns

Finally, use the estimate to determine your investment returns over time. For example, if you plan to invest $10,000 in a mutual fund with an annual rate of return of 8%, the Rule of 72 can be used to estimate that it will take approximately 9 years for your investment to double to $20,000.

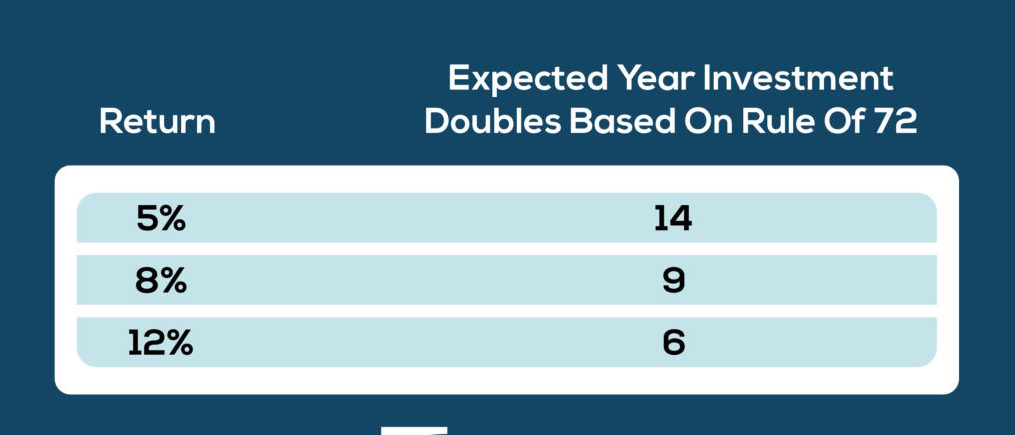

Rule of 72 chart

| Interest Rate | Years to Double |

|---|---|

| 1% | 72 |

| 2% | 36 |

| 3% | 24 |

| 4% | 18 |

| 5% | 14.4 |

| 6% | 12 |

| 7% | 10.3 |

| 8% | 9 |

| 9% | 8 |

| 10% | 7.2 |

Benefits of using the Rule of 72

The Rule of 72 is a useful tool for estimating investment returns because it is simple and easy to use. It can help investors make informed decisions about their investments and set realistic expectations for returns over time. Additionally, the Rule of 72 can be used to compare different investment options and determine which investment has the potential to yield higher returns.

Limitations of using the Rule of 72

The Rule of 72 is a simplified method used to estimate the time it takes for an investment to double based on a fixed annual growth rate. While it is a convenient rule of thumb, it has some limitations:

- Assumes constant growth: The Rule of 72 assumes a fixed annual growth rate, which may not accurately reflect real-world investment returns. In reality, investment returns can vary significantly over time.

- Ignores compounding frequency: The Rule of 72 does not take into account the compounding frequency of the investment. It assumes annual compounding, which may not be the case for all investments. Different compounding frequencies can affect the actual time it takes for an investment to double.

- Limited to doubling time: The Rule of 72 is specifically designed to estimate the time it takes for an investment to double. It does not provide information about other milestones or intermediate growth periods.

- Not applicable for negative or zero growth: The Rule of 72 assumes positive growth rates. If the growth rate is negative or zero, the rule does not provide meaningful results.

- Does not consider inflation or taxes: The Rule of 72 does not account for the impact of inflation or taxes, which can significantly affect the real return on an investment. These factors should be considered separately for accurate financial planning.

- Accuracy decreases with larger growth rates: The Rule of 72 tends to be less accurate when the growth rate is high. As the growth rate increases, the estimation provided by the rule becomes less precise.

It’s important to note that the Rule of 72 is a simple approximation and should not be relied upon as the sole basis for making investment decisions. It can be useful for quick calculations and providing a rough estimate, but more sophisticated financial analysis and modeling should be used for accurate projections and decision-making.

Conclusion

The Rule of 72 is a simple and easy-to-use formula that can help investors estimate investment returns over time. It is a useful tool for making informed investment decisions and setting realistic expectations for returns. However, investors should keep in mind the limitations of the Rule of 72 and consult with a financial advisor before making any investment decisions. By using the Rule of 72, investors can gain a better understanding of their investments and make smarter financial choices.

Financial Independence, Retire Early (FIRE) Explained: How It Works

Liked our article ? Subscribe to get weekly updates