Meta Description:

Discover the simple 25/50/15/10 money rule the wealthy use to build lasting wealth. Learn how the top 1% manage money – Learn how to invest, save, and spend smarter—no matter your income level.

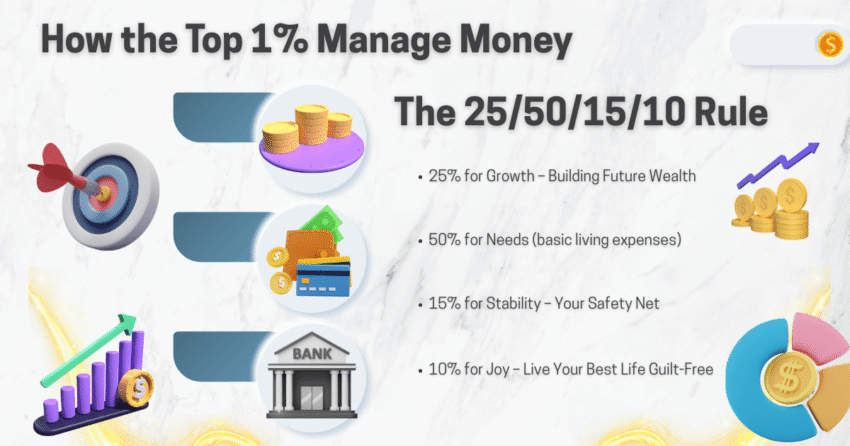

How the Top 1% Manage Money: The 25/50/15/10 Rule That Works for Everyone

Have you ever felt like no matter how much you earn, your money seems to disappear before the month is over? Meanwhile, people your age seem to be stacking wealth, buying assets, and living life with options. It’s not magic. It’s not luck. It’s a system—and today, we’re breaking down how the top 1% manage money differently.

The best part? This system works whether you earn ₹250,000 or ₹2,500,000 a year. Because wealth isn’t about how much you make, it’s about how you manage what you make. By the end of this article, you’ll have a practical, step-by-step money system you can actually follow—no gimmicks, just proven strategies.

The 25/50/15/10 Rule

This simple yet powerful formula balances growth, safety, and enjoyment:

-

25% for Growth – Investments and income-building opportunities.

-

50% for Essentials – Your cost of living.

-

15% for Stability – Emergency funds and insurance.

-

10% for Joy – Guilt-free fun and lifestyle.

Let’s break it down.

25% for Growth – Building Future Wealth

This is money that works for you, even while you sleep. It includes investments like index funds, rental properties, businesses, or upskilling that increases your income potential.

This is where you invest for long-term wealth creation. In India, this includes:

- Equities & Mutual Funds: SIPs in index funds or blue-chip stocks like Nifty 50 ETFs.

- PPF or NPS: For tax benefits and retirement planning.

- Side Hustles & Upskilling: Online courses, freelancing, or building small businesses.

Example:

- Ankit, a 28-year-old IT professional in Bengaluru, invests ₹15,000/month via SIP in an index fund and ₹5,000/month in NPS. Over three years, his portfolio grew by over ₹8 lakh while securing retirement benefits.

Pro Tip:

Automate investments through SIPs. Apps like Groww, Zerodha Coin, or Paytm Money make it easy.

50% for Essentials – Smart Spending on Needs

This covers housing, groceries, utilities, transportation, and insurance. The trap? Lifestyle inflation—spending more every time your income rises, buying a luxury car on EMI or upgrading to high-rent apartments unnecessarily.

Example:

- Priya was spending 70% of her salary on rent, dining out, and subscriptions. After applying the 50% rule, she moved to a more affordable apartment and cut unused OTT subscriptions, saving ₹25,000/month.

Pro Tip:

- Negotiate rent.

- Opt for term insurance and health insurance to avoid unexpected financial shocks.

- Use UPI and cashback-based credit cards smartly, but clear bills in full each month.

15% for Stability – Your Safety Net

Emergencies like medical expenses, job loss, or major car repairs are common in India. This bucket gives peace of mind.

What to Do:

- Maintain an emergency fund worth 6 months of expenses in a high-interest savings account or liquid mutual fund.

- Avoid using credit cards or personal loans during emergencies.

Example:

- Ramesh, an Ola driver in Pune, created an emergency corpus of ₹2 lakh over two years. When his car needed urgent repairs, he paid cash, avoiding a high-interest personal loan.

10% for Joy – Live Your Best Life Guilt-Free

Wealth isn’t just about saving; it’s also about enjoying life. Allocate 10% to things you love—travel, hobbies, dining out, or experiences.

Example:

- Neha, a 32-year-old marketing executive in Delhi, uses her joy fund for solo travel trips and online photography courses. It keeps her motivated to stick to her broader financial plan.

Pro Tip:

Keep a separate “Fun” account linked to UPI apps like PhonePe or Google Pay for easy tracking.

How to Implement the 25/50/15/10 Rule

- Audit Your Spending: Use apps like Walnut or Moneyfy to track where your money goes.

- Automate Everything: Set up auto-debits for SIPs and emergency fund contributions on payday.

- Start Small: If 25% investment seems tough, start at 10% and gradually increase.

- Keep It Simple: Don’t chase stock tips or crypto hype. Stick to diversified mutual funds and safe savings for stability.

Case Study: Aisha’s Money Plan

Aisha, a 24-year-old software tester in Hyderabad earning ₹60,000/month, applies this rule:

- ₹15,000 into SIPs and NPS (growth)

- ₹30,000 for rent, food, utilities (essentials)

- ₹9,000 for emergency fund & insurance premiums (stability)

- ₹6,000 for travel and hobbies (joy)

After two years, she built ₹3.6 lakh investments and ₹1.8 lakh emergency savings, all while enjoying life and staying debt-free.

Final Words – Build Wealth Like the Rich Do

The top 1% don’t rely on luck; they rely on systems. The 25/50/15/10 rule gives you a clear framework to:

- 25% – Build wealth via investments

- 50% – Manage your lifestyle smartly

- 15% – Protect against emergencies

- 10% – Enjoy guilt-free spending

Wealth is about ownership, planning, and discipline. No matter your income, start with one step—open an SIP, build an emergency fund, or simply track your spending. Your financial freedom starts with a plan.

ALSO READ

Follow me on Twitter (X) or Facebook. Join WhatsApp Channel or Facebook Group for Updates.

Liked our article ? Subscribe to get weekly updates