In the world of investing, where success is often elusive and market fluctuations can make or break your portfolio, finding strategies that can elevate your performance from average to extraordinary is a top priority. One such strategy gaining traction among savvy investors is Momentum Investing. In this blog post, we will delve into the concept of momentum investing and explore how it has the potential to transform your portfolio, helping you achieve exceptional returns. Get ready to unlock the secrets of this powerful investment approach and take your investment journey to new heights.

Understanding Momentum Investing

What is Momentum Investing?

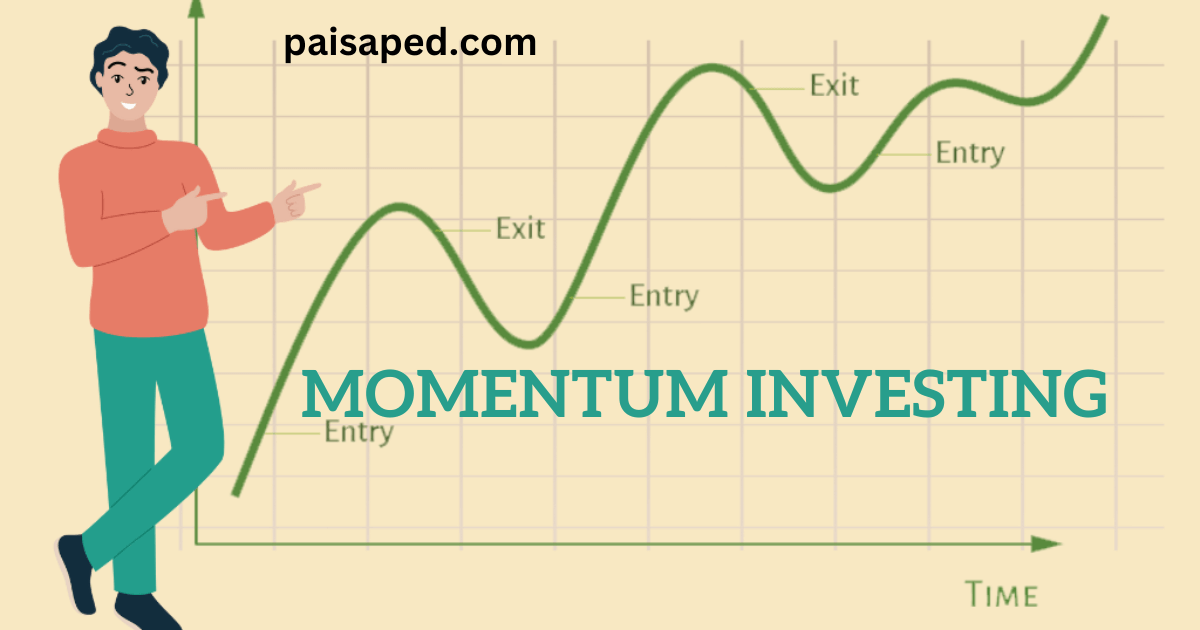

Momentum investing is based on the principle that stocks that have recently shown positive price trends are more likely to continue their upward trajectory, while stocks that have shown negative trends are more likely to continue their decline. This strategy capitalizes on the psychological tendency of investors to follow trends and ride the wave of market momentum.

The Advantages of Momentum Investing

Momentum investing, a strategy focused on identifying stocks with upward price trends, offers several advantages that can benefit investors seeking to achieve exceptional returns. Let’s explore the key advantages of momentum investing:

- Enhanced Returns: One of the primary advantages of momentum investing is its potential to generate above-average returns. The strategy aims to capture the momentum of stocks that have been performing well, allowing investors to ride the wave of their upward price trends. By focusing on stocks that are already showing strength, momentum investors seek to capitalize on the market’s winners and benefit from their continued upward movement.

- Risk Management: While momentum investing aims to maximize returns, it also incorporates risk management principles. The strategy follows the principle of “cut your losses and let your winners run.” When a stock starts to exhibit weak momentum or underperforms, momentum investors swiftly sell their positions to limit losses. Conversely, they hold onto stocks with strong momentum, allowing them to potentially continue their positive performance. This approach helps manage risk by minimizing losses and capitalizing on the stocks that are driving portfolio growth.

- Simple and Systematic Approach: Momentum investing offers a systematic and rules-based approach that can be easily implemented. Unlike more complex investment strategies, momentum investing relies on objective criteria such as price trends and relative strength indicators. This simplicity allows investors to establish clear guidelines for stock selection and portfolio management. By following a disciplined strategy based on well-defined rules, investors can avoid emotional decision-making and maintain a consistent approach to investing.

- Psychological Advantage: Momentum investing takes advantage of certain psychological tendencies exhibited by market participants. It capitalizes on the herd mentality and the human tendency to follow trends. When stocks exhibit strong momentum, they tend to attract more attention and buying interest from investors, further fueling their price appreciation. Momentum investors leverage this psychological bias to their advantage, aligning their investments with the prevailing market sentiment and potential market winners.

- Accessibility to Retail Investors: Momentum investing can be particularly accessible to retail investors who may not have extensive knowledge or resources for in-depth fundamental analysis. It relies heavily on technical indicators and price trends, which are readily available through various trading platforms, financial websites, and charting tools. This accessibility allows individual investors to participate in momentum investing strategies and potentially benefit from its advantages.

In short, momentum investing offers several advantages, including enhanced returns, risk management principles, a simple and systematic approach, psychological advantage, and accessibility. By leveraging the power of momentum, investors can aim for above-average returns while effectively managing risk. However, it’s important to note that like any investment strategy, momentum investing has its own risks and limitations. Conducting thorough research, staying informed, and considering individual financial goals and risk tolerance are crucial when implementing any investment strategy, including momentum investing.

Key Elements of a Momentum Investing Strategy

Momentum investing is a strategy that aims to capitalize on the trend-following behavior of financial markets. It involves identifying stocks or other financial assets that have exhibited strong recent performance and investing in them with the expectation that the upward trend will continue. Here are some key elements of a momentum investing strategy:

- Relative Strength: Momentum investors typically focus on the relative strength of a stock or asset. Relative strength compares the performance of a particular asset to that of its peers or a broader market index. Stocks that have shown stronger performance compared to others are considered to have positive relative strength.

- Price Trends: Momentum investors pay close attention to price trends. They look for stocks or assets that have shown consistent upward price movements over a defined period, such as six or twelve months. The idea is to invest in assets that have already demonstrated positive price momentum, indicating the potential for further gains.

Momentum Investing - Technical Indicators: Momentum investors often use technical indicators to identify trends and potential entry or exit points. These indicators may include moving averages, oscillators, or trend lines. Technical analysis tools can help investors spot patterns or signals that suggest the continuation of a price trend.

- Risk Management: While momentum investing can be lucrative, it also carries inherent risks. To manage risk, momentum investors may use stop-loss orders to protect against sudden price reversals. They may also diversify their portfolio by investing in multiple assets to spread risk.

- Rebalancing: Momentum investing typically involves regular portfolio rebalancing. As the relative strength and performance of different assets change over time, investors may need to adjust their positions. This involves selling assets that have lost momentum and reallocating funds to assets with stronger momentum.

- Short-term Holding Periods: Momentum investing is often associated with shorter holding periods. Momentum investors seek to capture short-term price movements, usually within a few months. They aim to exit their positions before the momentum starts to fade or reverses.

- Fundamental Analysis: While momentum investing is primarily driven by technical analysis and price trends, some investors may also consider fundamental factors. These factors could include earnings growth, revenue growth, or industry trends. Combining technical and fundamental analysis can provide a more comprehensive view when making investment decisions.

Tools and Resources for Momentum Investing

There are several tools and resources available to support momentum investors in their investment decision-making process. Here are some commonly used ones:

- Stock Screeners: Stock screeners help investors filter and identify stocks based on specific criteria such as price momentum, market capitalization, sector, and other technical or fundamental indicators. Popular stock screeners include Finviz, Yahoo Finance, and TradingView.

- Technical Analysis Software: Momentum investors often utilize technical analysis tools and software to analyze price charts, identify trends, and generate trading signals. Examples of popular technical analysis platforms include MetaTrader, Thinkorswim, and TradeStation.

- Charting Platforms: Charting platforms provide interactive price charts with various technical indicators and drawing tools to analyze past price movements and identify patterns. Examples include TradingView, StockCharts, and MetaTrader.

- News and Financial Data Providers: Staying updated with market news, company announcements, and financial data is crucial for momentum investors. Reliable sources for financial news and data include Bloomberg, Reuters, CNBC, Yahoo Finance, and Google Finance.

- Trend-Following Indicators: Momentum investors often rely on specific technical indicators to identify and confirm price trends. Examples of popular indicators used in momentum investing include moving averages (such as the 50-day or 200-day moving averages), relative strength index (RSI), stochastic oscillator, and MACD (moving average convergence divergence).

- Momentum ETFs and Funds: Exchange-traded funds (ETFs) and mutual funds that specifically target momentum strategies can be a convenient way for investors to gain exposure to a diversified portfolio of stocks exhibiting strong momentum. Examples of momentum-focused funds include iShares Edge MSCI USA Momentum Factor ETF (MTUM) and Invesco DWA Momentum ETF (PDP).

- Financial News and Analysis Websites: Websites that offer financial news, analysis, and investment insights can provide valuable information for momentum investors. Examples include Seeking Alpha, MarketWatch, CNBC, and Yahoo Finance.

- Online Communities and Forums: Participating in online communities and forums focused on investing and momentum strategies can allow investors to exchange ideas, discuss investment opportunities, and learn from others. Examples include Reddit’s r/investing and r/stocks communities, as well as various investing forums on websites like Seeking Alpha.

Momentum Investing Strategy

A momentum investing strategy involves identifying assets that have exhibited strong recent performance and investing in them with the expectation that the upward or downward trend will continue in the near term. Here are the key steps to implement a momentum investing strategy:

- Identify the Universe: Determine the universe of assets you want to focus on, such as stocks, bonds, or other financial instruments. It’s important to narrow down your scope to a manageable set of assets for analysis.

- Define the Lookback Period: Decide on the time period you will use to evaluate the performance of the assets. Common lookback periods range from three to twelve months, although it can vary depending on your preferences and the asset class being analyzed.

- Measure Relative Strength: Calculate the relative strength of each asset within your universe by comparing their recent performance to the performance of other assets. This can be done by calculating the ratio of an asset’s price change over the lookback period to the price change of a benchmark or a group of comparable assets.

- Select High-Momentum Assets: Identify the assets that have shown the highest relative strength values, indicating strong recent performance compared to their peers. These are the assets you may consider for investment.

- Set Entry and Exit Rules: Determine your specific entry and exit criteria. For example, you may decide to buy assets that have a relative strength value above a certain threshold, and sell assets if their relative strength drops below a specific level or if a trailing stop-loss order is triggered.

- Risk Management: Incorporate risk management techniques into your strategy. This may involve diversifying your portfolio across different asset classes or sectors, setting stop-loss orders to limit potential losses, or using position sizing techniques to manage the allocation of capital.

- Regular Monitoring and Rebalancing: Continuously monitor the performance of your portfolio and regularly reassess the relative strength of the assets. Rebalance your portfolio by selling underperforming assets and reallocating funds to assets that continue to show strong momentum.

- Combine with Other Analysis: Consider combining momentum analysis with other technical indicators or fundamental analysis to validate investment decisions. Additional analysis can provide a more comprehensive view of the assets and help reduce potential false signals.

- Evaluate Performance: Regularly evaluate the performance of your momentum investing strategy to assess its effectiveness. Compare the returns generated by your strategy against appropriate benchmarks and adjust your approach if necessary.

Note: Remember that momentum investing carries risks, including the potential for market reversals or false signals. It is important to conduct thorough research, manage risk effectively, and diversify your investments to mitigate potential downsides.

Momentum Investing Indicators

Momentum investing relies on various indicators to identify assets with strong recent performance and determine the potential continuation of the trend. Here are some commonly used momentum indicators:

- Relative Strength Index (RSI): The RSI is a popular momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions. Traders often look for assets with RSI values above 70 as potential sell signals and values below 30 as potential buy signals.

- Moving Averages: Moving averages are trend-following indicators that smooth out price fluctuations over a specified period. Two commonly used moving averages are the 50-day and 200-day moving averages. Momentum investors may look for assets with prices trading above their moving averages as a signal of positive momentum.

- Rate of Change (ROC): ROC calculates the percentage change in price over a specified period. It measures the speed of price movement and helps identify assets with strong momentum. A positive ROC indicates upward momentum, while a negative ROC suggests downward momentum.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that calculates the difference between two exponential moving averages (usually 12-day and 26-day). It also includes a signal line (usually a 9-day exponential moving average). Momentum traders watch for bullish crossovers (when the MACD line crosses above the signal line) as potential buy signals and bearish crossovers (when the MACD line crosses below the signal line) as potential sell signals.

- Stochastic Oscillator: The stochastic oscillator compares an asset’s closing price to its price range over a specified period. It measures the strength of the current price relative to its historical price range. A reading above 80 indicates overbought conditions, while a reading below 20 indicates oversold conditions. Traders often look for assets with stochastic values above 80 as potential sell signals and values below 20 as potential buy signals.

- Average Directional Index (ADX): ADX measures the strength of a trend, regardless of its direction. It ranges from 0 to 100, with values above 25 indicating a strong trend. Momentum investors may consider assets with high ADX values as potential candidates for investment.

- Bollinger Bands: Bollinger Bands consist of a simple moving average with upper and lower bands that represent two standard deviations from the average. They help identify overbought and oversold conditions and can indicate potential reversal or continuation of a trend.

These indicators can be used individually or in combination to assess the momentum of assets. It’s important to note that no single indicator guarantees accurate predictions, and it is often beneficial to use multiple indicators and conduct thorough analysis before making investment decisions.

Dual Momentum Investing

Dual momentum investing is an investment strategy that combines both absolute momentum and relative momentum to make investment decisions. It aims to capture returns by investing in assets with positive momentum and avoiding or hedging assets with negative momentum. Here’s how dual momentum investing works:

- Absolute Momentum: Absolute momentum, also known as time-series momentum, focuses on the performance of individual assets over a specific lookback period. It compares the current price of an asset to its historical price to determine whether it has positive or negative momentum. If an asset’s price has increased over the lookback period, it is considered to have positive momentum and may be a candidate for investment. If the price has decreased, indicating negative momentum, the asset may be avoided or hedged.

- Relative Momentum: Relative momentum, also known as cross-sectional momentum, compares the performance of different assets within a specified universe. It identifies assets that have performed better than their peers over a given period. The assets with the highest relative strength or relative performance are considered to have positive relative momentum and may be selected for investment.

- Switching between Asset Classes: Dual momentum investors typically allocate their portfolio across different asset classes, such as equities, bonds, commodities, or cash, based on the momentum signals. During periods of positive absolute momentum, the portfolio is invested in the asset class or assets with the strongest momentum. In times of negative absolute momentum, the portfolio may shift to defensive assets or cash to avoid potential losses.

- Rebalancing: Dual momentum investors regularly rebalance their portfolios based on the momentum signals. This involves selling underperforming assets and reallocating funds to assets with stronger momentum. The frequency of rebalancing can vary depending on the investor’s preference and the time frame of the strategy.

- Risk Management: Risk management is an integral part of dual momentum investing. Investors may employ techniques such as stop-loss orders, position sizing, or dynamic asset allocation to manage risk. Additionally, diversification across asset classes helps spread risk and reduce exposure to individual assets.

Dual Momentum Investing aims to participate in strong market trends while avoiding assets experiencing negative momentum. By combining absolute and relative momentum, it attempts to capture upside potential and protect against downside risks. However, it’s important to note that like any investment strategy, dual momentum investing carries risks, and careful analysis and monitoring are essential for successful implementation.

Does Momentum Investing work ?

Momentum investing has been studied extensively in academic research and has shown mixed results. While there have been periods where momentum strategies have outperformed the market, there have also been periods of underperformance. Here are some key points to consider regarding the effectiveness of momentum investing:

- Empirical Evidence: Numerous studies have documented the presence of short- to medium-term momentum effects in various financial markets, including stocks, bonds, and commodities. These studies suggest that assets that have performed well in the past tend to continue outperforming, while assets that have performed poorly tend to continue underperforming in the near term.

Momentum Investing - Behavioral Explanation: The momentum effect is often attributed to behavioral biases and market inefficiencies. Investor psychology, herding behavior, and delayed reaction to news can create momentum in prices. This provides an opportunity for momentum investors to profit from the market’s tendency to persist trends.

- Market Efficiency and Reversals: Some critics argue that momentum investing challenges the efficient market hypothesis, which states that asset prices already reflect all available information. They argue that if momentum investing consistently generated excess returns, it would attract more investors, leading to price reversals and reducing its profitability.

- Volatility and Risk: Momentum strategies can be volatile and experience significant drawdowns during market reversals or periods of increased volatility. Therefore, momentum investing may not be suitable for all investors, particularly those with lower risk tolerance or longer investment horizons.

- Factor Crowding: Momentum investing has become popular, leading to increased participation and potential factor crowding. If many investors pursue the same momentum strategies simultaneously, it could impact market dynamics and reduce the strategy’s effectiveness.

- Combination with Other Strategies: Some investors may combine momentum investing with other strategies, such as value investing or fundamental analysis, to diversify risk and enhance returns. Combining multiple factors or investing styles can potentially provide a more robust investment approach.

It’s important to note that the effectiveness of momentum investing can vary across different market conditions, asset classes, and timeframes. Additionally, past performance is not a guarantee of future results, and thorough research, risk management, and portfolio diversification are crucial for any investment strategy. As with any investment approach, it’s recommended to carefully assess your own investment goals, risk tolerance, and time horizon before adopting a momentum investing strategy. Consulting with a financial advisor can also provide personalized guidance based on your individual circumstances.

Momentum Investing Funds

Momentum Investing Funds in India:

- Axis Midcap Fund: While not solely focused on momentum investing, Axis Midcap Fund adopts a combination of growth and momentum investing strategies. The fund invests primarily in mid-cap stocks that have the potential for long-term growth and attractive momentum characteristics.

- Franklin India High Growth Companies Fund: This fund aims to provide long-term capital appreciation by investing in growth-oriented Indian companies. While it primarily focuses on growth investing, the fund may consider momentum factors in stock selection.

- Invesco India Dynamic Equity Fund: This fund employs a dynamic asset allocation strategy based on market conditions and momentum indicators. It aims to generate capital appreciation by investing in equity and equity-related securities.

Momentum Investing Funds in the United States:

- AQR Momentum Fund (AMOMX): This fund seeks long-term capital appreciation by investing in U.S. and non-U.S. equity securities that exhibit momentum characteristics.

- JPMorgan U.S. Momentum Factor ETF (JMOM): Although an ETF, it is worth mentioning as it focuses on U.S. stocks with strong momentum characteristics. The fund seeks to track the performance of the JP Morgan US Momentum Factor Index.

Momentum Investing Funds in other countries:

- Fidelity Global Dynamic Equity Fund: This fund focuses on global equities and aims to achieve long-term capital growth by investing in stocks with attractive momentum characteristics.

- Pictet – Global Environmental Opportunities Fund: While primarily an environmental-focused fund, it also incorporates a momentum-driven investment approach. It invests in companies that benefit from, or contribute to, the transition to a more sustainable economy.

- BlackRock Global Long/Short Equity Fund: This fund seeks to achieve long-term capital appreciation by investing in a global portfolio of long and short equity positions. It incorporates momentum factors in its investment approach.

Note : Please note that the availability and specific characteristics of momentum investing funds may vary across different countries. It’s important to conduct thorough research, review the fund’s investment strategy, performance track record, expense ratios, risk factors, and consult with a financial advisor before making any investment decisions.

Momentum Investing ETFs

Momentum Investing ETFs in India:

- ICICI Prudential Nifty Next 50 ETF

- Motilal Oswal Midcap 100 ETF

- Aditya Birla Sun Life Nifty Midcap 150 ETF

- Edelweiss ETF-Nifty 100 Quality 30

Momentum Investing ETFs in the United States:

- iShares Edge MSCI USA Momentum Factor ETF (MTUM): Focuses on large and mid-cap U.S. stocks with strong momentum characteristics.

- Invesco DWA Momentum ETF (PDP): Tracks the Dorsey Wright Technical Leaders Index, selecting U.S. stocks with strong relative strength and technical indicators.

- SPDR S&P 500 Momentum ETF (SPMO): Tracks the S&P 500 Momentum Index, consisting of U.S. large-cap stocks with positive price momentum.

- First Trust Dorsey Wright Focus 5 ETF (FV): Selects the five First Trust sector and industry ETFs with the highest relative strength.

Momentum Investing ETFs in other countries:

- iShares MSCI ACWI Momentum ETF (ACWV): Invests globally in developed and emerging market stocks with strong momentum and low volatility characteristics.

- Xtrackers MSCI World Momentum Factor UCITS ETF (XMWO): Tracks the MSCI World Momentum Index, which focuses on global large and mid-cap stocks with strong momentum characteristics.

- Lyxor MSCI World Momentum Factor UCITS ETF (MOOV): Seeks to replicate the performance of the MSCI World Momentum Index, composed of developed market stocks with strong momentum factors.

- SPDR MSCI World Momentum Factor UCITS ETF (SWDM): Tracks the MSCI World Momentum Index, which comprises global large and mid-cap stocks with positive momentum.

Note: Please note that the availability and specific characteristics of momentum investing ETFs may vary across different countries. It’s important to conduct thorough research, review the prospectus, expense ratios, liquidity, and underlying index methodology of these ETFs before making any investment decisions. Additionally, consulting with a financial advisor can provide personalized guidance based on your investment objectives and risk tolerance.

Frequently Asked Questions (FAQs)

- What is momentum investing?

- Momentum investing is an investment strategy that involves buying securities that have shown strong recent performance and selling securities that have shown weak recent performance. The strategy is based on the belief that assets that have exhibited upward or downward trends in the past will continue to do so in the near future.

- How do you identify stocks with momentum?

- Stocks with momentum can be identified by looking at their recent price performance. Typically, investors look for stocks that have shown consistent upward price movements over a specific period, such as six or twelve months. Relative strength indicators and technical analysis tools can also help identify stocks with positive momentum.

- What are the risks associated with momentum investing?

- Momentum investing carries several risks. There is a risk of buying at the peak of a trend, leading to potential losses if the momentum reverses. Additionally, sudden market reversals, volatility, and behavioral biases can impact the strategy. It is important to employ risk management techniques, such as diversification and setting stop-loss orders, to mitigate these risks.

- Is momentum investing suitable for long-term investing?

- Momentum investing is generally associated with shorter holding periods, typically ranging from a few months to a year. It is primarily used as a tactical or intermediate-term strategy. While it is possible to apply momentum principles to longer-term investing, it may not align with the goals and time horizon of all long-term investors.

- Can momentum investing be combined with other investment strategies?

- Yes, momentum investing can be combined with other investment strategies. Some investors may choose to incorporate momentum factors into a broader investment approach, such as a factor-based or quantitative strategy. It can also be used in conjunction with fundamental analysis or other technical analysis indicators to refine investment decisions.

- Are there specific sectors or markets where momentum investing works best?

- Momentum investing can be applied to various sectors and markets. However, it is important to consider that different sectors and markets may exhibit varying levels of momentum and volatility. Some investors may focus on specific sectors or asset classes that historically have shown strong momentum characteristics, such as technology stocks or emerging markets.

- How frequently should a momentum investor rebalance their portfolio?

- The frequency of portfolio rebalancing for momentum investors may vary depending on individual preferences and market conditions. Some investors rebalance their portfolio on a regular basis, such as monthly or quarterly, while others may adjust their positions based on specific triggers or changes in relative strength. Regular monitoring of portfolio holdings is important to maintain the desired momentum exposure.

- Can momentum investing be applied to other financial instruments besides stocks?

- Yes, momentum investing can be applied to other financial instruments besides stocks. It can be utilized with other asset classes such as bonds, commodities, currencies, or even alternative investments like cryptocurrencies. The underlying principle of identifying and capitalizing on trends remains the same, but the specific indicators and techniques may vary across different asset classes.

Conclusion

Momentum investing offers a compelling opportunity for investors to transform their portfolios and achieve extraordinary returns. By capitalizing on market trends, selecting stocks with positive momentum, and implementing effective risk management techniques, investors can potentially outperform the market and elevate their investment performance. Remember to conduct thorough research, utilize appropriate tools and resources, and stay disciplined in following your momentum investing strategy. Embrace the power of momentum investing and take your investment journey from average to extraordinary.

Investment Strategies : A Guide to Choosing the Right Investment Strategy for You

Liked our article ? Subscribe to get weekly updates

1 thought on “From Average to Extraordinary: How Momentum Investing Can Transform Your Portfolio”